Buying a home is one of the most significant financial decisions you’ll make in your lifetime. While the process might seem straightforward, it’s filled with potential pitfalls that can lead to financial loss, legal complications, and unnecessary stress. Using a licensed Realtor provides you with expertise, protection, and peace of mind throughout the transaction. Here’s a detailed breakdown of 7 compelling reasons why hiring a Realtor is essential when buying a home in Edmonton.

1. Minimizing Exposure to Risk

Real estate transactions are complex and involve significant legal and financial obligations. Without professional guidance, buyers can unknowingly enter into contracts that disadvantage them or overlook critical details about a property.

Example of Risk

In Edmonton, a buyer purchased a home privately, unaware that the property had a history of flooding. Without a Realtor’s due diligence, they failed to inspect historical records or consult experts. After moving in, they faced over $50,000 in repair costs due to water damage (source: "Edmonton Home Buyer Stories: Why Due Diligence Matters," Edmonton Journal, March 2023). This was a massive expense that could have been avoided with professional advice.

Realtors are trained to identify red flags, such as zoning violations, liens on a property, or undisclosed issues like structural damage. They ensure that inspections and necessary documentation are completed, safeguarding your investment.

2. Expert Negotiation Skills

Negotiation is a cornerstone of a successful home purchase. Realtors are seasoned professionals who know how to navigate offers, counteroffers, and contingencies to secure the best deal for their clients.

Market Insights: Realtors understand current market trends and can advise whether a property is overpriced or undervalued.

Tactful Negotiations: They handle emotionally charged discussions, ensuring you don’t overpay or miss out due to poor communication.

Without a Realtor, you risk overpaying or missing out on favorable terms, such as seller concessions or needed repairs before closing. For instance, a buyer in Calgary, Alberta, attempted to negotiate directly with a seller and overlooked the opportunity to request essential roof repairs. This oversight led to an unexpected $20,000 expense shortly after moving in (source: "Real Estate Risks: Calgary Buyers' Lessons," CBC News, February 2023).

3. Access to a Vast Network

Realtors have an extensive network of industry professionals that can streamline your home-buying process. This network includes mortgage brokers, home inspectors, appraisers, and contractors.

Early Access to Listings: Realtors often have access to properties before they hit public markets, giving you an advantage in competitive areas.

Trusted Referrals: Their connections ensure that you work with reputable professionals, saving you time and money.

4. Market Knowledge

Understanding the local real estate market is crucial for making informed decisions. Realtors possess in-depth knowledge about neighborhoods, school districts, property values, and future developments that could affect your investment.

For instance, if you're buying a home in Edmonton’s Hamptons or Edgemont communities, I've lived in these neighborhoods since 2011 and in Edmonton for 39 years and will be happy to guide you to the best streets, homes, and amenities that match your lifestyle. With years of experience and a deep connection to the Edmonton market and the people that make this city great, I offer tailored advice to help buyers make informed decisions.

5. Handling Paperwork and Legalities

Buying a home involves extensive paperwork, including contracts, disclosures, and legal documents. A single oversight can result in delays, financial penalties, or even legal action.

Realtors ensure that:

All documents are correctly completed and submitted.

Deadlines are met to prevent breaches of contract.

You understand every aspect of the paperwork before signing.

For example, in Ontario, a buyer tried to complete a real estate transaction without a Realtor, leading to missed deadlines and an unenforceable contract. This oversight resulted in a legal dispute and the loss of their deposit (source: "DIY Real Estate: Risks and Challenges," Toronto Star, May 2023).

6. Protecting Your Interests

Realtors are legally obligated to act in your best interests. They’re your advocate, ensuring you make informed decisions and aren’t taken advantage of during the transaction.

Without this professional advocacy, buyers are more susceptible to pressure from sellers or their agents, who prioritize the seller's interests.

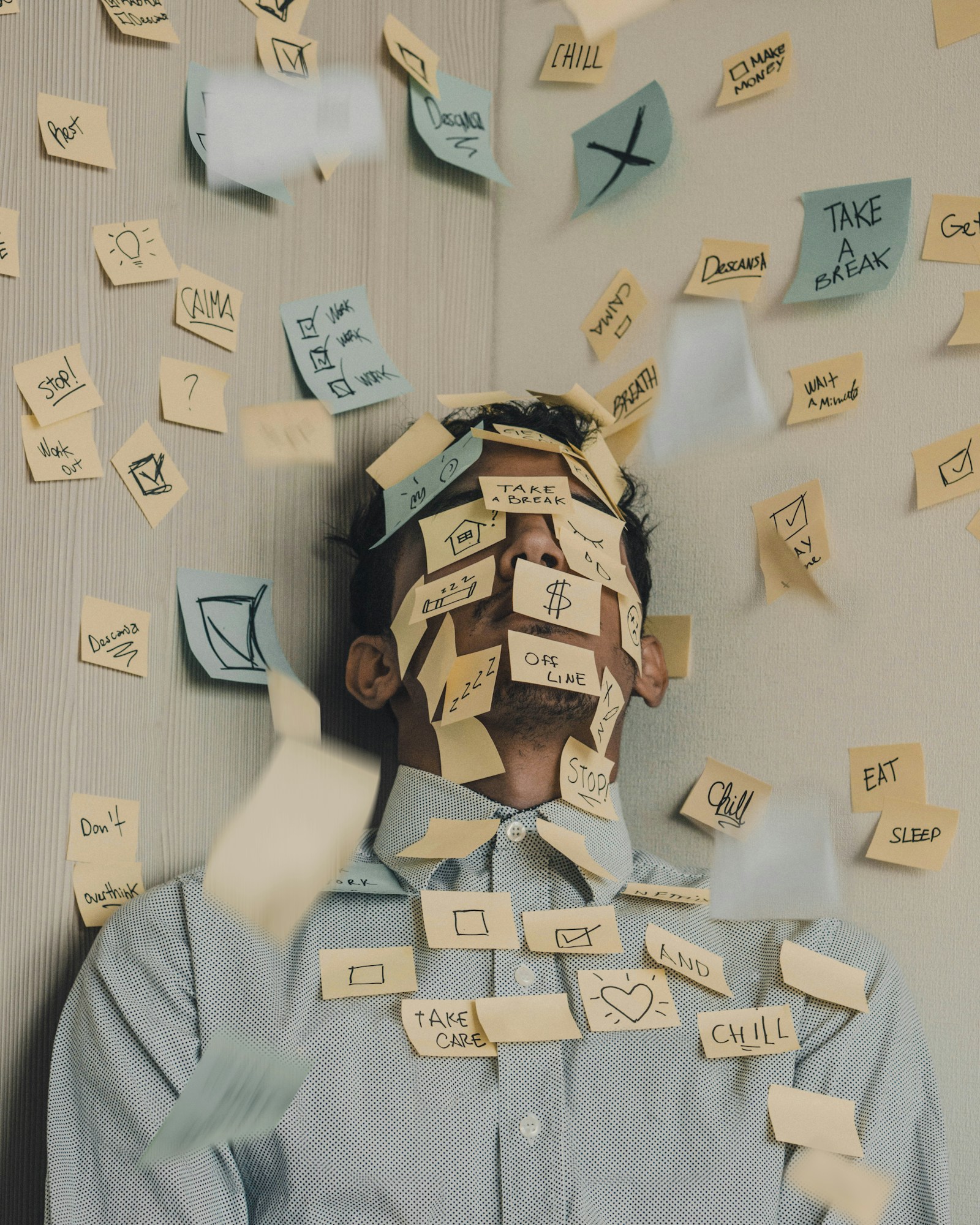

7. Saving Time and Reducing Stress

House hunting, scheduling inspections, negotiating terms, and handling paperwork can be overwhelming. Realtors streamline these processes, reducing stress and freeing up your time for other priorities.

A Realtor takes on the heavy lifting of finding properties that meet your criteria, setting up showings, and coordinating with sellers. They ensure that every step—from initial property searches to final closing—proceeds efficiently. By handling time-consuming tasks such as researching property histories, arranging inspections, and liaising with other professionals, Realtors allow you to focus on planning your move and enjoying the excitement of a new home.

Beyond logistics, Realtors act as a buffer between you and sellers. They manage negotiations and address any issues that arise, shielding you from unnecessary pressure. For example, if a seller proposes unexpected changes to the contract, your Realtor will advocate on your behalf to resolve the situation quickly and favorably.

Realtors also keep the process on track by ensuring that deadlines are met and paperwork is completed accurately. Missed deadlines can lead to delays or even the cancellation of a deal. A Realtor’s attention to detail minimizes these risks, giving you peace of mind throughout the process.

In addition, Realtors can draw on their professional networks to quickly resolve challenges. Whether you need a last-minute inspection or assistance with financing, a Realtor can connect you to trusted experts who will expedite the process. This network access saves valuable time and ensures you work with reputable service providers.

Frequently Asked Questions (FAQ)

1. Do I need a Realtor to buy a home in Edmonton?

While it’s possible to buy a home without a Realtor, it’s not recommended. Realtors bring expertise in negotiations, legal processes, and market knowledge, helping you avoid costly mistakes. They also act as your advocate, ensuring you get the best deal possible.

2. How does a Realtor protect my interests during a home purchase?

Realtors are legally obligated to act in your best interests. They ensure contracts are fair, negotiate on your behalf, and address issues such as inspection findings or unexpected contract changes. Their goal is to protect your investment and ensure a smooth transaction.

3. Can a Realtor help me find homes before they are listed publicly?

Yes! Realtors often have access to exclusive listings and network connections, giving you a head start in competitive markets like Edmonton.

4. What does it cost to work with a Realtor as a buyer?

In most cases, the seller pays the Realtor’s commission, meaning you can benefit from their services at no direct cost to you as a buyer. A qualified Realtor will be able to explain how they add value to the process while looking out for your best interests.

5. How do I choose the right Realtor in Edmonton?

Look for a Realtor with deep local knowledge, a proven track record, and strong communication skills. Someone like me, who has lived in Edmonton for 39 years and who has over 10 years of experience in high-volume sales roles and complex negotiations.

Conclusion

When you’re ready to buy your first home in Edmonton, having a trusted guide by your side can make all the difference. As a Realtor who has lived in Edmonton for nearly four decades and who calls the communities of Edgemont and The Hamptons my home, I understand first-hand what it's like here day-in and day-out.

Buying a home should be an exciting and rewarding experience—not a stressful one.

If you’re ready to start this exciting chapter, call or text 780-232-2064. Together, we’ll find the perfect home for you and your family.