Embarking on the journey of purchasing your first home is both exciting and complex. As a first-time buyer, it's essential to familiarize yourself with the key professionals who will guide you through this process. Understanding their roles, how they are compensated, and what to expect at each stage will empower you to make informed decisions and avoid costly liabilities or financial risks.

1. Real Estate Agent

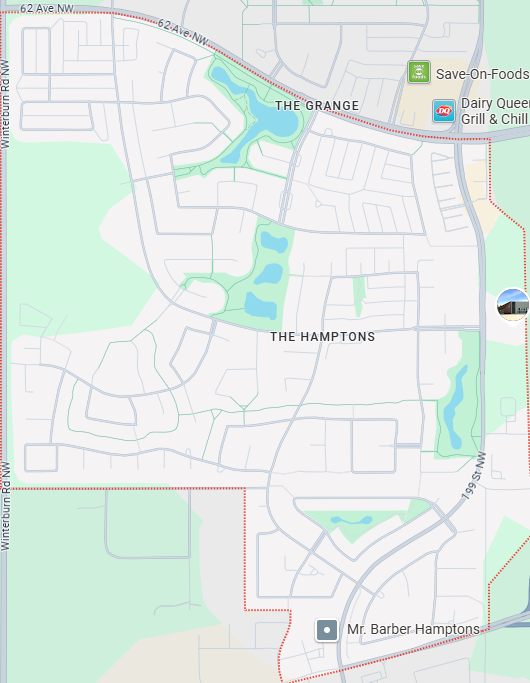

Role: Your real estate agent assists in finding suitable properties, negotiating offers, and navigating the purchasing process. They provide valuable insights into neighborhoods, market trends, and property values.

Compensation: In Canada, the seller typically pays the real estate commission, which is then split between the seller's and buyer's agents. This means, as a buyer, you usually don't pay your agent directly. Commissions vary from transaction to transaction - in fact, each Realtor is able to negotiate their fees for each transaction. In Edmonton, commissions are usually 3.5% of the first $100 000 of the purchase price, and 1.5% of the remaining balance for both the selling agent and the buyer’s agent. Typically, buyers will not need to pay any commissions out of pocket as they will be disbursed from the purchase price at the time of possession.

2. Mortgage Broker or Lender

Role: Mortgage brokers help you secure financing by connecting you with lenders and finding mortgage products that suit your financial situation. Alternatively, you can work directly with a lender, such as a bank or credit union, to obtain a mortgage.

Compensation: Mortgage brokers are typically paid by the lender through a commission upon the successful closing of a mortgage. This commission is usually a percentage of the loan amount, and the percentage will vary depending on factors like whether you are being financed through an “A” lender or a “B” lender. In most cases, this means there is no direct cost to you as the borrower. However, it's essential to discuss any potential fees upfront and ask your mortgage professional how they are compensated for their time and work.

Understanding the Mortgage Process:

Pre-Approval: Before house hunting, obtain a mortgage pre-approval to determine how much you can afford. This involves a lender assessing your financial situation and creditworthiness. In Edmonton, because of the strong seller’s market offers are generally not being accepted without proof of a completed pre-qualification.

Application: Ideally, before you start shopping for a property you'll complete a mortgage application, providing detailed financial information and documentation. This may include tax information, employment verification and pulling detailed banking records.

Approval and Closing: After approval, the lender will provide a commitment letter outlining the mortgage terms. During closing, funds are transferred, and the mortgage is finalized.

3. Home Inspector

Role: A home inspector evaluates the property's condition, examining structural components, systems, and appliances to identify any existing or potential issues. This assessment helps you make informed decisions and negotiate repairs if necessary. This is not a “pass” or “fail” and the inspector’s role is simply to advise you on their findings. Because this is a non-invasive inspection, not all potential issues that may exist with a property will be revealed. Talk with your Realtor about the limitations of the inspection process.

Compensation: Home inspectors charge a fee for their services, typically ranging from $500 to $800, depending on the property's size and location. This fee is paid by the buyer at the time of the inspection. Additional fees may be billed for rural properties, sewer scoping, radon testing and additional services.

Remember, there is value in getting an inspection whether you’re purchasing a character home built 80 years ago or a new build - in fact, it’s not uncommon to see lots of deficiencies in new builds, so be sure to know what you’re buying. View the inspection as an investment, and an important step that could relieve future stress and avoid future headaches.

What to Expect During the Inspection:

Duration: Inspections usually take 2 to 3 hours. Your Realtor is required to be on site throughout, although as a buyer you are not required to be present (though we strongly encourage you to be there!).

Areas Covered: Inspectors assess the roof, foundation, plumbing, electrical systems, HVAC, insulation, and will also check for evidence of leaks or moisture where it shouldn’t be.

Report: You'll receive a detailed report outlining findings, including photographs and recommendations for repairs or further evaluations. This report is not automatically shared with your Realtor, so be sure to discuss the results with them directly.

4. Real Estate Lawyer

Role: A real estate lawyer ensures all legal aspects of the transaction are handled appropriately. They review contracts, conduct title searches, facilitate the transfer of funds, and ensure the property's title is clear of liens or encumbrances.

Compensation: Legal fees can vary but typically range from $500 to $1,500, depending on the complexity of the transaction and the lawyer's experience. This fee is paid by the buyer and is part of the closing costs.

5. Condominium Document Reviewer (If Applicable)

Role: When purchasing a condominium, it's crucial to review the corporation's documents, including bylaws, financial statements, reserve fund studies, and meeting minutes. A professional condo document reviewer analyzes these documents to assess the building's financial health and any potential issues.

Compensation: Fees for condo document reviews typically range from $300 to $500, depending on the service provider and the depth of the review. This fee is paid by the buyer. Your Realtor is mandated not to provide the Condominium Document Review report. This process is conducted by a licensed third party to ensure an impartial review.

Importance of Condo Document Review:

Financial Health: Ensures the condominium corporation has adequate funds for maintenance and repairs.

Bylaws and Rules: Helps you understand any restrictions or obligations as an owner.

Potential Issues: Identifies any ongoing disputes, pending lawsuits, or special assessments that could affect you.

Closing Costs

In addition to the fees mentioned above, be prepared for other closing costs, which can include:

Land Transfer Taxes: Varies by province and municipality - chat with your Realtor for specific information.

Title Insurance: Protects against potential title issues; costs typically range from $200 to $400. This is handled by the seller and may be offered in lieu of a Real Property Report (we’ll get into the nitty gritty in a future newsletter).

Adjustments: Reimbursements to the seller for prepaid expenses, such as property taxes or utilities.

Overall, closing costs can amount to approximately 1.5% to 4% of the home's purchase price depending on the specific property and the complexity of the transaction.

Final Thoughts

Purchasing your first home involves collaboration with various professionals, each playing a vital role in ensuring a smooth transaction. Understanding their functions and compensation structures helps you navigate the process confidently. Always communicate openly with your team, ask questions, and ensure you fully comprehend each step before proceeding.

FAQ

Q: Do I need to hire all these professionals when buying my first home?

A: While it's possible to handle some aspects independently, engaging these professionals ensures that each part of the transaction is handled expertly, reducing risks and providing peace of mind. It’s Mike’s opinion that you should never purchase a property without an inspection, and the value of a qualified and knowledgeable lawyer can not be understated.

Q: What professionals do I need to hire to buy my first home in Edmonton?

You’ll typically work with the following professionals:

Real estate agent – Helps you find and buy the right home.

Mortgage broker or lender – Secures financing for your purchase.

Home inspector – Assesses the condition of the home.

Real estate lawyer – Handles legal paperwork, title transfer, and closing.

Condo document reviewer – If buying a condo, they review the building's financial and legal documents.

Each professional plays a specific role to protect your investment and guide you through the home-buying process.

Do I pay my real estate agent as a first-time buyer in Edmonton?

No. In Alberta, the seller usually pays the real estate commission, which is then split between the seller’s agent and the buyer’s agent. You benefit from your agent’s expertise without paying them out of pocket.

How are mortgage brokers paid in Alberta?

Mortgage brokers are typically paid a commission by the lender once your mortgage is finalized. This means their services are usually free to you as the buyer. However, always ask up front if any broker fees apply in your case.

What does a home inspection cost in Edmonton?

A standard home inspection in Edmonton costs between $500 and $800, depending on the size, age, and type of property. This is a one-time fee paid by the buyer and is due at the time of inspection.

Is a home inspection required to buy a home?

A home inspection is not legally required, but it is highly recommended every time - whether you’re buying a new home or a resale property. It can uncover costly issues that aren’t visible during showings and help you negotiate repairs or walk away from a bad deal.

When do I hire a real estate lawyer in Edmonton?

You’ll usually hire a real estate lawyer after your offer is accepted. They handle:

Title searches and title insurance

Reviewing the purchase agreement

Registering the property in your name

Managing the transfer of funds on closing day

Legal fees typically range from $500 to $1,500, depending on the transaction. Mike will be happy to provide you the names of qualified and highly-reviewed lawyers that he’s worked with personally.

Do I need a lawyer to buy a condo in Edmonton?

Yes, and if you're buying a condo, it's also recommended that you hire a professional condominium document reviewer. They'll check:

The financial health of the condo corporation

Reserve fund studies

Special assessments or legal disputes

Bylaws that might affect your lifestyle (e.g., pet or rental restrictions)

Review fees are usually around $300 to $500, and you, as the buyer, pay this.

What are closing costs for a first-time buyer in Edmonton?

Closing costs in Edmonton typically include:

Legal fees: $500–$1,500

Home inspection: $300–$500

Title and mortgage registration fees: Around $820 for a $400,000 home with a $320,000 mortgage

Title insurance: $200–$400 (optional but recommended)

Condo document review (if applicable): $300–$500

Altogether, budget 1.5% to 4% of the home price for closing costs.

Does Edmonton have a land transfer tax?

No. Alberta does not charge a land transfer tax, unlike Ontario or BC. Instead, buyers pay Land Title Transfer Fees and Mortgage Registration Fees, which are typically much lower.

For example, on a $400,000 home with a $320,000 mortgage, your fees would total around $820.

Do I need mortgage pre-approval before house hunting?

Yes, it’s strongly recommended. A mortgage pre-approval:

Shows sellers you’re serious

Helps you set a realistic price range

Locks in an interest rate for up to 120 days (in many cases)

What happens on closing day?

On closing day, your lawyer:

Confirms all legal documents are complete

Transfers the purchase funds to the seller’s lawyer

Registers you as the new legal owner of the home

You’ll receive the keys once everything is finalized—usually by late afternoon.

Thanks for taking the time to review this information! I’d love to connect with you. Reach out via text at (780) 232-2064 or email mike@pabianrealty.ca.