Why this matters now: Edmonton’s west end is on track for two city-shaping upgrades by 2028—the Valley Line West Light Rail Transit extension to Lewis Farms, and the Lewis Farms Recreation Centre with Public Library and District Park. These projects will improve everyday access, commute options, and family amenities across Rosenthal, Secord, Edgemont, Lewis Estates, The Hamptons, The Grange, Webber Greens, and Glastonbury—and they can influence buyer demand, seller strategy, and pricing dynamics between now and opening day. (City of Edmonton)

What is coming (and where)

Valley Line West Light Rail Transit: Downtown to Lewis Farms

The Valley Line West is an approximately fourteen-kilometre extension from Downtown, running along 104 Avenue and Stony Plain Road, continuing west past West Edmonton Mall to Lewis Farms. Construction is anticipated to be complete in 2028, followed by a period of testing and commissioning before opening to passengers. The City’s 2025 construction update highlights a push to complete most roadwork and set many roads into their final configuration by spring of 2026. (City of Edmonton)

Lewis Farms Recreation Centre, Public Library, and District Park

This flagship complex will include a fifty-metre pool, twin ice arenas, fitness centre, double gymnasium, studios and multi-purpose rooms, an Edmonton Public Library branch, and a district park. Construction began in 2023 and is anticipated to be complete in 2028. An Alberta Major Projects profile lists the project as under construction with a multiyear schedule through 2028. (City of Edmonton)

Do rail lines always raise prices? The honest, local view

Edmonton-specific research using spatial difference-in-differences methods found negative price impacts for single-detached homes very close to stations, with some spillover beyond the immediate zone—likely due to noise and activity effects. (IDEAS/RePEc)

Broader peer-reviewed literature shows multi-family homes near well-planned, walkable stations often capture premiums, while effects vary by city, distance, housing type, and station design. In other words, uplift is not automatic—housing type and micro-location matter most. (JTLU)

Practical takeaway: Homes one or two turns away from the busiest frontages often balance convenience and quiet. Townhomes and condominiums, on the other hand, generally do better if situated directly adjacent - or even attached to - amenities like LRT stations, office buildings, restaurants and cafes or shopping. So, if you’re in an apartment style condo with easy access to LRT your values might increase a bit, but if you have an established detached home facing a train station (especially because you will be at ground level with increased foot traffic) you’re likely to see your values fall.

Neighbourhood-by-neighbourhood outlook

Rosenthal (Lewis Farms)

Why it is poised: Walk- or bike-friendly access to the future Lewis Farms transit hub and the recreation centre makes Rosenthal compelling for families and commuters. Expect townhomes and newer duplexes on quiet interior streets within a comfortable walking distance to attract strong demand.

Dive deeper: My recent article, Welcome to Rosenthal: West Edmonton’s Backyard In Bloom takes a more focused look into the community of Rosenthal and why it is highly sought after. (Mike Pabian)

Secord

Why it is poised: A large supply of family-friendly detached homes with straightforward access to Lewis Farms and the coming recreation centre.

Buyer note: Think in terms of a first-and-last 5 minute plan in winter (sidewalks, snow, and realistic bus frequency to the hub) when evaluating whether the location is a fit. For example, how far will you need to walk in order to get from your door to the bus?

Edgemont

Why it is poised: Although not directly on the rail alignment, Edgemont benefits from quick road links and bus connections to Lewis Farms plus strong west-end retail options including FreshCo, Dollarama, Tim Hortons and several local shops. Homes here should see steady demand as 2028 nears, and the area is still being developed - meaning you have a choice of new builds and existing homes.

Helpful resource: Check out my recent article, Rent vs. Buy in Edmonton: Why Owning Your Home Makes More Sense Than Ever if you’re on the fence about diving into the housing market.

Lewis Estates (including Potter Greens, Suder Greens, Webber Greens, Breckenridge Greens, and more)

Why it is poised: Mature landscaping, proximity to West Edmonton Mall and Misericordia Community Hospital, and direct access to the future rail terminus support downsizers and families wanting car-light daily living near services. Official planning documents place Suder Greens and Webber Greens within the Lewis Farms Area Structure Plan, underscoring their proximity to the upcoming terminal. (webdocs.edmonton.ca)

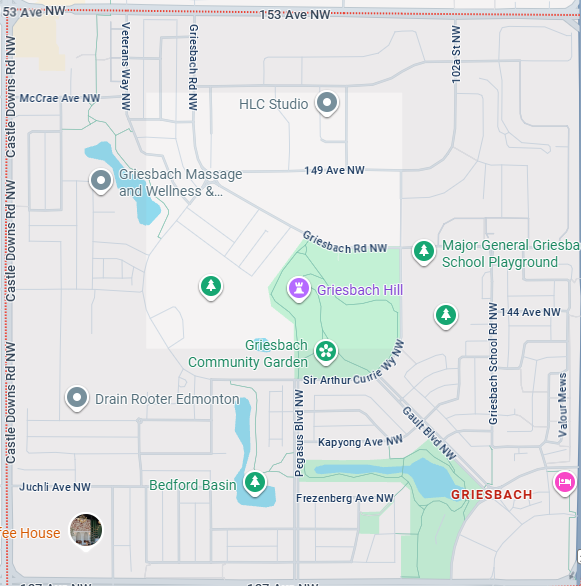

Webber Greens (within Lewis Estates)

Why it is poised: Very close to the future transit hub, with convenient access to parks, golf, and retail anchors like Save-On Foods, Canadian Brewhouse, Brown’s SocialHouse, and FreshCo. Family-oriented housing types—especially townhomes and well-kept single-family homes—should benefit from the recreation-plus-rail story. Not only that, but it’s become a desireable community for young families, with its abundance of schools, sledding, bike paths and sports fields. (webdocs.edmonton.ca)

The Grange (Glastonbury, Granville, The Hamptons)

Official composition: The City defines The Grange Area Structure Plan as comprising Glastonbury, Granville, and The Hamptons. (City of Edmonton)

The Hamptons (within The Grange)

Geography: The Hamptons forms the southern portion of The Grange and extends west to 215 Street (Winterburn Road). It benefits from direct road links toward Lewis Farms and the coming recreation centre while retaining established trails and schools. (City of Edmonton)

Glastonbury (within The Grange)

Why it is poised: Established streets, storm-pond paths, and convenient retail at The Grange centre make Glastonbury attractive to buyers wanting suburban calm with relatively fast access to Lewis Farms. Townhomes near everyday services often lease quickly and turn over less, which also appeals to investors. (Wikipedia)

Granville (within The Grange)

Why it is poised: Modern retail and services, strong road connections to Lewis Farms, and housing stock that works for both first-time buyers and downsizers. This area is home to Costco, a veterinary clinic, a 24/7 GoodLife Fitness, schools, and parks. It’s also just minutes away from River Cree Resort and Casino, which is undergoing a massive renovation that will add a high-rise tower and waterpark.

What usually happens around opening milestones

Construction years (now through 2027): Photos and drive times can look rough during detours, but informed buyers often secure pre-amenity pricing—especially on quiet-street homes within a comfortable walk of the future hub. The City continues to signal construction complete in 2028, then testing. (City of Edmonton)

Completion year (2028): Ribbon-cuttings and media attention can boost sentiment and absorption (a fancy term for the purchase of vacant or new properties) near stations and major amenities, particularly for townhomes and condominiums that promote walkability and convenience to prospective buyers. (City of Edmonton)

Twelve to twenty-four months after opening: Utilization rates for nearby amenities (in this case, the transit hub and rec centre) increase as habits and weekend routines become entrenched among the residents of a community. Well-located homes often see a decrease in the number of days it takes to sell. It should be noted, however, that being close to amenities makes homes more attractive, but there’s a tipping point. Being directly accross the street from a major attraction, for example, might be too close for comfort if you value peace, quiet, and privacy.

Buyer playbook: how to choose well (and win)

“One-turn-off” rule: Prioritize quiet interior streets within a five- to twelve-minute walk of the Lewis Farms transit hub or a future station: close enough for convenience, removed enough for peace.

Flexible layouts: Lower-level space for multigenerational living or home offices keeps demand durable.

Underwrite your commute: Study the City’s route and station maps now to make a realistic plan for bus-to-train travel once the line opens. (City of Edmonton)

Considering a condominium? Choose buildings that are walkable to groceries, childcare, clinics, and everyday services, not just the rail stop itself. For pitfalls to avoid, link readers to your west-end-relevant piece: [“What Can Go Wrong When Buying a Condo in Edmonton—And How to Avoid It”]. (Mike Pabian)

Seller playbook: how to position ahead of opening

Sell the “five-minute life”: In photos, video, and feature sheets, explicitly map the Lewis Farms Recreation Centre, Public Library, future Valley Line West stations, West Edmonton Mall, and local schools.

Sound and serenity: If your home is close to a busier frontage, invest in window and door upgrades and privacy landscaping and showcase indoor sound measurements plus a quiet rear deck in your media.

Timing choices: Listing ahead of the 2028 opening captures lifestyle-driven movers; if you are immediately beside a high-traffic segment, consider listing after streetscape and landscaping works are complete.

Investor angle: rentals, house-hacking, and resilience

Townhomes and apartment-style condos near everyday services tend to move quickly and generally retain their value

Detached homes near stations: Be conservative on price-growth assumptions; focus on net operating income and tenant demand in the long run

Short-term rental versus long-term rental: The City requires short-term rental licensing and has been actively reviewing stricter rules. For more information and details on what you need to know, give me a call at 780-232-2064.

Frequently Asked Questions

Will the Valley Line West Light Rail Transit definitely open in 2028?

The City states construction is anticipated to be complete in 2028. After that, the line must pass testing and commissioning before opening to passengers. Project pages and updates are the best way to track progress. (City of Edmonton)

Will the Lewis Farms Recreation Centre and Library really open in 2028?

The City’s project page indicates construction is anticipated to be completed in 2028. The Alberta Major Projects database lists it as under construction with a 2023–2028 schedule. (City of Edmonton)

Does proximity to rail always increase property values?

Not always. Edmonton-specific research finds near-station single-detached homes can experience price decreases, while multi-family near walkable stations in other cities often sees premiums. Effects depend on distance from stations, housing type, and streetscape design. (IDEAS/RePEc)

Which specific neighbourhoods make up The Grange?

The Grange Area Structure Plan contains Glastonbury, Granville, and The Hamptons. The Hamptons forms the southern portion of The Grange and extends west to 215 Street (Winterburn Road). (City of Edmonton)

Where do Webber Greens and Suder Greens fit?

Both are neighbourhoods within the Lewis Farms Area Structure Plan, located very near the future Lewis Farms transit hub. (webdocs.edmonton.ca)

Bottom line

Lifestyle uplift is real: Modern rail access plus a flagship recreation centre and public library will change daily life in the west end.

Price effects are nuanced: What you buy and where on the block you buy matter more than the headline project.

The opportunity window is now: The period before opening is when you can still purchase quality locations at pre-amenity pricing—and sell with a compelling “coming soon” story.

Book a free fifteen-minute West-End Game Plan. I will build a plan by address. We’ll figure out the commute, traffic and noise exposure, resale comparisons by product type, and everything else you need in order to make an informed decision.

Sources

City of Edmonton—Valley Line West project overview and 2025 construction update. (City of Edmonton)

City of Edmonton—Lewis Farms Recreation Centre, Public Library, and District Park project page. Alberta Major Projects profile. (City of Edmonton)

City of Edmonton—The Grange Area Structure Plan (official documents and neighbourhood profiles); The Hamptons neighbourhood profile (southern portion of The Grange). (City of Edmonton)

City of Edmonton—Lewis Farms and Webber Greens planning documents (placement and boundaries). (webdocs.edmonton.ca)

Peer-reviewed research on rail impacts to prices, including Edmonton-specific findings and broader meta-evidence. (IDEAS/RePEc)