If you’re hunting for a more affordable way to get into a home in Edmonton—without giving up a yard, a driveway, and a little breathing room—you’ve likely stumbled across land lease communities. They show up under a few labels (“land lease,” “leasehold,” “manufactured home community,” “pad sites”), and for the right buyer they can be a smart, budget-friendly path into homeownership.

Here’s the full picture in plain English: what land lease communities are, how they differ from buying a condo or fee-simple townhome, how financing and Alberta’s rules come into play, and the real-world pros and cons for buyers and sellers. In the Edmonton area, there are 3 main communities - Evergreen, Maple Ridge, and Westview Village.

Quick definition: in a land lease, you own the home but lease the land underneath it from a community owner or landlord. You pay monthly pad/site rent for the lot, and you’re responsible for the house itself. (RE/MAX Blog)

What is a Land Lease Community?

At its simplest, a land lease community is a neighbourhood where residents own their dwelling (often a manufactured or modular home, sometimes site-built) but rent the lot it sits on. In Alberta, when you own the home and rent the site, your tenancy is governed by the Mobile Home Sites Tenancies Act (MHSTA)—a statute with rules specific to mobile/manufactured home sites (rent increases, notices, assignments, dispute resolution, etc.). (Alberta.ca)

Many communities include paved roads, landscaping, and basic services; some add amenities like a clubhouse or park space. You’ll typically budget for:

Pad (site) rent to lease the lot

Utilities/services (sometimes bundled)

Insurance, taxes, and maintenance on your home (the community owner covers land costs; your lease explains the breakdown)

Leasehold vs. Freehold (and Where Condos Fit)

Freehold single family/townhome: you own land + building.

Condominium: you own your unit plus a share of common property through the condo corporation; you pay condo fees for operations and reserves.

Leasehold (land lease): you own the structure but lease the land from a landlord; you pay pad rent and follow community rules.

Functionally, leasehold swaps the condo board for a landlord/community operator and swaps the condo fee for pad rent (some communities also have HOA-style fees if they offer additional amenities). RE/MAX Canada’s primers on land leases underline these differences and why buyers consider the model in the first place. (RE/MAX Blog)

How Long Are Land Leases?

Across Canada, long-term leases are common—often 20 to 99 years—with the agreement spelling out payment schedules, permitted uses, renewal mechanics, and how fees can be reviewed or adjusted. Always read those sections closely and line them up with your intended holding period. (RE/MAX Blog)

Financing: The Big Non-Negotiable

Before you shop, talk to your mortgage broker about current leasehold underwriting. For insured loans, CMHC typically requires the remaining lease term at the start of the mortgage to exceed the amortization by at least five years; importantly, renewal/option periods usually don’t count toward that test. If the lease is too short, financing can be limited or more expensive. (Your lender’s policy controls—confirm for your file.) (CMHC)

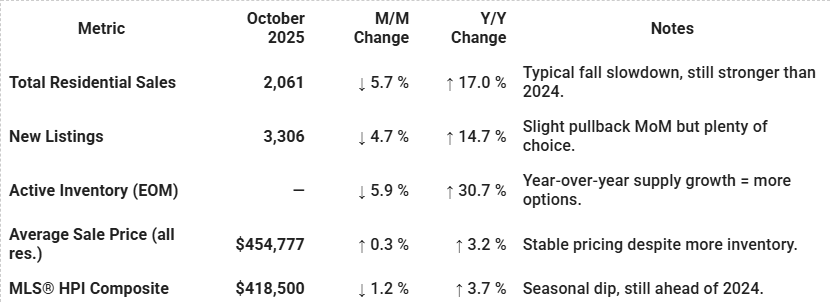

Land Lease vs. Condo vs. Freehold: The Side-by-Side

| Feature |

Land Lease (Leasehold) |

Condo (Unit in a Condo Corp) |

Freehold Townhome |

| You own… |

The home |

The unit + share of common property |

Land + building |

| Monthly mandatory cost |

Pad rent (site), sometimes HOA |

Condo fee |

None (beyond taxes/HOA if present) |

| Rulebook |

Lease + community rules |

Bylaws, board rules |

Municipal bylaws; any HOA |

| Financing nuance |

Lease term must satisfy lender/insurer rules |

Standard condo underwriting |

Standard freehold underwriting |

| Exit complexity |

Buyer must accept lease + get landlord approval |

Buyer accepts bylaws/financials |

Typical resale process |

(Details vary. Your offer should be conditional on financing and legal review of the lease or bylaws/estoppel package.)

Why Buyers Choose Land Lease (Pros)

Lower upfront price. Because you’re not buying the land, purchase prices for the home are usually lower than comparable freehold properties—one of the biggest drivers for first-time buyers and downsizers. RE/MAX highlights affordability as a core benefit. (RE/MAX Blog)

Access to better locations or amenities. Some land lease communities sit in desirable areas or package in amenities—clubhouses, greenspace, sometimes security—delivering lifestyle value without the land price tag. (RE/MAX Blog)

Simple living, community feel. Consistent standards, quiet internal roads, and a neighbourly vibe are common draws.

Budget clarity. Pad rent is known in advance and is governed by the MHSTA’s rules on notice and increases, so you can plan cash flow more confidently. (Alberta.ca)

Where Land Lease Can Fall Short (Cons)

You still have a monthly site cost. Pad rent sits beside your mortgage, utilities, and insurance. Leases can include periodic reviews or renewal adjustments—model both the likely and worst-case scenarios in your budget. (RE/MAX Blog)

Lease term risk. A short remaining term can limit financing and affect resale value (remember the CMHC “amortization + five years” rule of thumb). (CMHC)

Rules and approvals. Expect community standards: pets, parking, exterior changes, additions—all subject to the lease and operator approvals.

Resale complexity. Your buyer must qualify with both the lender and the landlord and accept the lease. Higher pad rent or restrictive rules can narrow the buyer pool vs. a similar freehold.

Appreciation dynamics. Because you’re not buying the land, your equity growth is tied more to the home’s condition, age, and demand than to rising land values. RE/MAX calls out the potential for lower appreciation relative to freehold in some markets—something to bake into your long-term plan. (RE/MAX Blog)

Seller/Homeowner Considerations

Pros:

Stable demand at lower price points. Separating land cost can open the door to first-time buyers and right-sizers.

Predictable community standards. Well-run sites maintain curb appeal, which helps values.

Watch-outs:

Marketability depends on the paperwork. Remaining lease term, current/forecast pad rent, and renewal mechanics are front-and-centre for buyers and lenders.

Renovation ROI math changes. Since land is the main appreciation engine in freehold, big upgrades in a leasehold need sharper scrutiny.

Alberta-Specific: The MHSTA (What It Means in Practice)

Alberta’s Mobile Home Sites Tenancies Act applies when a resident owns the mobile/manufactured home but rents the pad. It sets minimum standards for landlords and tenants, including rules for rent increases and notice, assignments (selling your home and transferring the lease), and dispute processes. If you’re buying or selling in a land lease community around Edmonton, your contract should reference the MHSTA and the site lease; get a lawyer to explain how the clauses interact with your possession timeline and financing. (Alberta.ca)

Where These Fit in Edmonton (and How I Help You Compare)

In West Edmonton communities I work in daily—Edgemont, The Hamptons, Secord, Rosenthal, Lewis Estates—we can put land lease homes head-to-head with condos and fee-simple townhomes. The key is an apples-to-apples total cost of ownership view:

Land lease: mortgage + pad rent + taxes/insurance + routine upkeep

Condo: mortgage + condo fee (ops + reserves) + taxes/insurance + routine upkeep

Freehold: mortgage + taxes/insurance + routine upkeep (+ any HOA)

From there, we layer in lease term, amenities, community rules, and your preferred lifestyle. Often the answer reveals itself once we run the numbers for your price point and timeline.

Frequently Asked Questions (FAQ)

What exactly is a land lease, again?

You own the structure (home) and lease the land (the lot) from a landlord or community owner, paying pad rent for the site. (RE/MAX Blog)

How long are land leases?

Residential land leases are commonly long-term—often 20 to 99 years—with payment schedules, use restrictions, and renewal terms spelled out in the agreement. (RE/MAX Blog)

Do banks lend on land lease homes?

Often, yes—but lease terms matter. For insured mortgages, CMHC typically expects the lease term to outlast the amortization by at least five years (renewal options usually don’t count). Confirm current policy with your lender/broker before waiving financing. (CMHC)

Is pad rent like a condo fee?

Both are ongoing monthly costs but pay for different things. Pad rent compensates the landowner and may include shared services; condo fees fund your own condominium corporation’s operations and reserve fund (future capital work).

Can pad/site rent go up?

Yes. Leases often include review and renewal mechanisms, and the MHSTA sets rules for increases and notice in Alberta. Read the clause and model both likely and conservative scenarios. (Alberta.ca)

Who pays property taxes?

You insure, maintain, and pay taxes on your home; the landowner pays taxes on the land (typically recovered through pad rent). Your lease will spell out specifics.

Are land lease homes always “mobile” or moveable?

Most are sold in place. Moving a manufactured home is possible in certain cases but costly and regulated. Plan to buy and sell on the same site, subject to landlord approval.

Is this the same as buying on Crown or Indigenous land?

Different frameworks. Some land-lease situations involve Crown or Indigenous lands with distinct authorities and policies; your lender and lawyer will treat those differently. Start the disclosure and financing conversation early. (RE/MAX Blog)

Bottom Line (and Next Steps)

A land lease can be a fantastic fit if you value lower upfront cost, amenities, and simple living, and you’re comfortable with pad rent in exchange for not tying up capital in land. It’s less ideal if you want maximum control over the land itself, dislike recurring site rent, or you’re working with a lease that’s too short for your financing.

If you’re curious about a specific community or a listing you’ve seen, I’ll:

Run the math—mortgage + pad rent vs. mortgage + condo fee vs. freehold.

Review the lease with you (term, assignments, renewals, scheduled increases) and coordinate the legal/financing checkpoints.

Compare communities so you buy into the lifestyle you actually want.

Want a side-by-side for two properties you’re eyeing? Shoot me the links—I’ll build you a clear, Edmonton-specific comparison so you can decide with confidence.

Disclaimer: I’m a REALTOR®, not a lawyer or financial advisor. This article is general information for Alberta and may not reflect your exact situation. Always obtain legal and mortgage advice before making a decision.

Sources & references:

RE/MAX Canada, “What is a Land Lease?” (definition, model overview). (RE/MAX Blog)

RE/MAX Canada, “The Land Lease Option: An Affordable Way to Own a Home” (lease length ranges, amenities, affordability, renewal considerations). (RE/MAX Blog)

Government of Alberta, “Renting a mobile home site” (MHSTA overview for pad tenancies in Alberta). (Alberta.ca)

CMHC, “Affordable Housing Fund: Land Lease Requirements” (lease term must exceed amortization by 5 years; renewal/options typically excluded). (CMHC)