For many aspiring homeowners in the Greater Edmonton Area, buying a home in 2025 still feels like climbing a financial mountain. Rising home prices, inflation-driven living costs, and evolving mortgage rules have made one thing crystal clear: the down payment is often the biggest barrier to home ownership.

But here’s the good news — more Edmontonians are finding creative, practical ways to overcome this hurdle than ever before. If you’re a first-time home buyer feeling overwhelmed by the idea of saving tens of thousands of dollars, you’re not alone.

Let’s break down the reality of down payments in Edmonton, explore why it’s so challenging, and highlight the smart strategies buyers are using right now to secure their first homes — even in a competitive seller’s market.

💰 Why Is the Down Payment Still So Hard?

In 2025, the average home price in Edmonton sits around $409,000, up approximately 9–12% year-over-year (source: RAE March 2025 Statistics). That means a 5% minimum down payment on an average home is approximately $20,450 — and that’s before factoring in closing costs, legal fees, inspections, and moving expenses.

Despite a slight softening of inflation and stabilizing mortgage rates, affordability remains a major issue. In fact:

Over 21% of first-time buyers in Canada report saving for six years or more to afford a down payment (CMHC).

Roughly 30% rely on family gifts or early inheritances to bridge the gap.

Many still underestimate total upfront costs, which can add another 1.5–4% to their budget.

This is where knowledge — and strategy — becomes power.

📈 What’s New in 2025: More Support, More Flexibility

While the down payment remains a challenge, recent changes in federal policy and local market conditions are giving buyers some much-needed breathing room.

✅ First Home Savings Account (FHSA) – The Game Changer

Introduced in 2023, the FHSA has quickly become the go-to savings vehicle for new buyers. It combines the tax-deductible benefits of an RRSP with the tax-free withdrawal power of a TFSA.

Key features for Edmonton buyers:

Contribute up to $8,000 annually (up to $40,000 lifetime)

Contributions are tax-deductible, lowering your income tax burden

Withdrawals for a qualifying home purchase are completely tax-free

Can be used alongside the RRSP Home Buyers’ Plan (up to $35,000 per person)

📊 Pro Tip: Couples can pool FHSA + RRSP savings to access over $100,000 in down payment funds.

✅ 30-Year Amortization on Insured Mortgages

New for 2025, the federal government has reintroduced the 30-year amortization option for first-time buyers purchasing new homes with insured mortgages.

This move:

Lowers monthly payments by spreading the loan over more years

Helps buyers qualify for higher loan amounts under stricter stress-test rules

Is intended to boost affordability and reduce entry barriers for younger Canadians

✅ Provincial Incentives and Municipal Supports

While Alberta doesn’t offer a provincial land transfer tax (a major advantage over provinces like Ontario or BC), some municipalities — including Edmonton — are exploring property tax deferrals, energy-efficiency grants, and first-time buyer education programs to support affordability.

🧠 Smart Strategies: How Edmonton Buyers Are Getting It Done

Savvy first-time home buyers in Edmonton are finding creative, actionable ways to make the dream a reality.

🏡 Stacking Financial Tools

Many buyers now combine multiple savings and support strategies to maximize their purchasing power:

FHSA + RRSP Home Buyers’ Plan = Up to $75,000 tax-advantaged savings per person

Employer RRSP match programs (when available)

Automated savings apps that round up purchases and funnel change into a savings account

🛠 Tip: Set up a separate “Home Fund” account and automate transfers weekly or bi-weekly.

👪 Leveraging Family Support (Responsibly)

The “Bank of Mom and Dad” is alive and well, but today’s buyers are taking a more structured approach:

Gift letters for lenders to confirm the money isn’t a loan

Co-signing arrangements to help meet debt-service requirements

Shared ownership or duplex purchases with family to offset costs

📉 Cutting Lifestyle Costs for a Big Reward

Many buyers are:

Downsizing rental units or moving in with family short-term

Selling second vehicles or switching to transit to save on insurance and gas

Delaying big-ticket purchases like vacations or electronics

These sacrifices often result in $10,000–$25,000 saved in under 2 years.

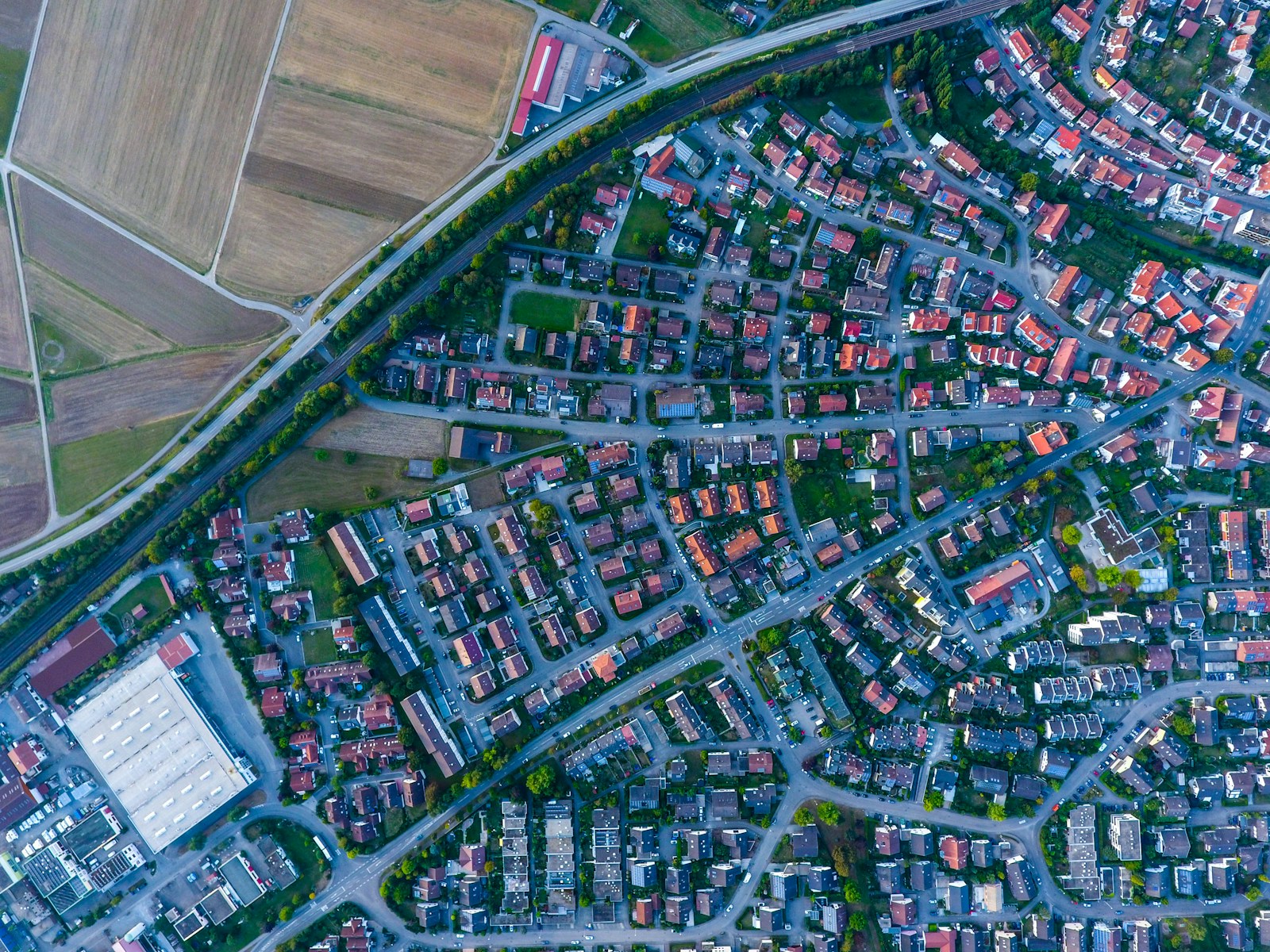

🌄 Widening the Search

More buyers are looking beyond Edmonton’s core into surrounding communities like:

Spruce Grove

Stony Plain

Fort Saskatchewan

Leduc

Beaumont

These areas offer:

Lower average home prices (up to 20–25% less)

Newer homes and larger lots

A more relaxed pace of life, with easy commutes via Anthony Henday and QEII

🧭 Final Thoughts: The Path to Home Ownership in 2025

While the road to a down payment in Edmonton isn’t always easy, it’s more achievable now than it’s been in years — if you have the right roadmap.

With tax-free savings programs, supportive family structures, creative budgeting, and local market knowledge, the dream of owning a home is within reach for first-time buyers across Edmonton and surrounding communities.

🎯 Want to accelerate your path to homeownership?

Let’s build a personalized strategy based on your unique situation. I specialize in helping buyers in Edgemont, The Hamptons, and west-end Edmonton create practical, step-by-step plans — from saving to keys in hand.

📝 FAQ: Down Payments in Edmonton – What You Need to Know

Q: What’s the minimum down payment required in Canada?

A: For homes under $500,000, you need a minimum of 5%. For homes between $500,000 and $999,999, it’s 5% on the first $500,000 and 10% on the remainder. Homes over $1 million require a 20% down payment, and cannot be insured.

Q: Is the FHSA better than the RRSP for saving a down payment?

A: Not necessarily better — just different. The FHSA allows for both tax-deductible contributions and tax-free withdrawals, while RRSP Home Buyers' Plan requires repayment. Using both together is often the most powerful strategy.

Q: What are CMHC premiums and can I avoid them?

A: CMHC mortgage insurance is mandatory for down payments under 20%. It protects lenders but costs you 2.8–4.0% of your loan. Avoiding it requires a 20% down payment, but many buyers choose to pay the premium in order to enter the market sooner.

Q: How long does it take to save a down payment in Edmonton?

A: The average is 5–7 years, but with tools like the FHSA and family support, many buyers reduce this to 2–3 years, or even faster with a dedicated savings strategy.

Q: What are the hidden costs beyond the down payment?

A: Expect to budget 1.5–4% for:

Closing costs

Legal fees

Title insurance

Inspections/appraisals

Moving expenses

Utility connection fees

Q: Is it better to buy in Edmonton or the surrounding communities?

A: It depends on your lifestyle and budget. Surrounding areas like Stony Plain or Beaumont offer more space for less money, but may increase your commute. Many buyers find a great balance in these markets.

👋 Ready to Own in 2025?

Whether you’re just starting your down payment journey or ready to buy this year, I can help you map out your next steps.

📞 Book your free buyer consultation today

📍Serving the Greater Edmonton Area

📧 Visit PabianRealty.ca to get started or call/text (780) 232-2064