15 things to do before the deep freeze to protect your house, your wallet, and your sanity

Edmonton winter doesn’t roll in gently. It drops a shoulder, gets those elbows up, and goes straight through you.

By late October, we’re already flirting with freeze-up. Then, from November through March, we live in a climate where –20°C is normal, and –30°C (or worse with windchill) happens often enough that everyone owns a block heater and two backup space heaters. Temperatures as low as –40°C are not unheard of, including –43.6°C at the International Airport during the February 2021 cold wave and historical records down near –49°C. (Wikipedia)

That level of cold is not just uncomfortable. It’s a stress test for your furnace, your windows, your plumbing, and your home’s resale value. A well-prepped Edmonton house feels warm, quiet, and trustworthy in January, and buyers absolutely pay attention to that.

This guide will help you:

Stay warm without lighting money on fire,

Avoid plumbing disasters,

Show buyers (or appraisers) that your home is cared for,

Sleep through those first -30°C nights instead of pacing the hallway in slippers.

Let’s get started with 15 essential steps, why they matter here specifically, and what they cost if you don’t do them.

1. Book a proper furnace tune-up (not just “I changed the filter”)

Your furnace is about to work nonstop. In Edmonton, HVAC companies openly market true 24/7 emergency response in winter because a furnace dying at –25°C is a safety emergency: pipes can freeze, interior temps can crash in hours, and you’re suddenly on the phone in the middle of the night. Local furnace repair companies advertise round-the-clock emergency service specifically to restore your heat quickly, because losing the ability to heat your home isn’t just annoying; it’s an emergency. (furnacefamily.com)

Remember that emergency calls in the cold are more expensive than preventative care. Furnace repair in Edmonton commonly runs around $195–$400 per visit, and serious failures (blowers, heat exchangers) can jump into four figures, with full replacements easily in the $5K–$7K+ range. (alwaysplumbing.ca)

Compare that to a fall furnace service. A normal tune-up is typically quoted around $150–$200 in Alberta/Edmonton, which lines up with broader Canadian/US averages of roughly $70–$200 for a tune-up and ~$150–$500 per year for full annual maintenance. (alwaysplumbing.ca)

Ask your tech to:

Clean and test the burners and flame sensor (that tiny sensor failing is a classic “furnace won’t fire at 2 a.m.” situation),

Confirm the blower motor isn’t drawing too much current,

Check for carbon monoxide leaks,

Make sure the humidifier and furnace fan settings are dialed for winter circulation. (atcoenergy.com)

For resale: Being able to tell a January buyer, “Yes, the furnace was serviced this fall, here’s the receipt,” instantly lowers their fear.

2. Swap your furnace filter now — and check it every month in winter

Clogged filters choke airflow. When airflow is restricted, the furnace runs hotter and longer to hit the same thermostat setting, which raises your bill and increases wear. Poor airflow is one of the reasons furnaces lock out in cold snaps — exactly when you can’t afford downtime — and also one of the most common causes for those middle-of-the-night emergency calls. (Sunny Edmonton)

A decent filter is $10–$30. A middle-of-the-night callout in January is not.

Bonus: Clean filters = quieter system = the house “feels newer” during a showing.

3. Hit the drafts: weatherstrip doors and seal around windows

In our climate, uncontrolled air leaks are money leaks.

Windows, doors, and skylights can account for up to roughly 25–35% of a home’s total heat loss in Canada, and cold-climate energy guidance says that sealing gaps and weatherstripping can reduce heating and cooling costs by 10–20% (sometimes more) while immediately improving comfort. (Natural Resources Canada)

Even tiny gaps around a back door or a settling crack at a window trim can drive up your winter gas bill. In Edmonton, that’s not theoretical — we spend literal months below freezing, sometimes over 100 straight days where the average daytime high doesn’t crack 0°C. (The Weather Network)

What to do today:

Add fresh weatherstripping to the door between the garage and the house. That door is often the single coldest air pathway in newer west-end homes, and sealing garage air off the house keeps –20°C air from dumping into your kitchen.

Physically lock all operable windows. Locking pulls the sash tighter against the seal.

Run exterior-grade caulking where siding meets trim if you see daylight. Alberta home maintenance and energy-efficiency guidance specifically recommends caulking and weatherstripping as fast, high-impact DIY moves. (The Department of Energy's Energy.gov)

Buyers feel this. A house that’s warm at the edges in January signals “cared for,” not “drafty and overpriced money pit that’s going to bleed gas money forever.”

4. Clean your gutters and confirm downspouts are extended

Here’s classic Edmonton winter physics:

Chinook-y warm afternoon melts rooftop snow.

Meltwater hits a clogged eavestrough and has nowhere to go.

Overnight it drops to –20°C again, that meltwater freezes and forms an ice dam.

Water backs up under shingles, down behind fascia, and (in bad cases) into the attic and drywall.

Local roofing and home-maintenance guidance for Edmonton is blunt: clean gutters and downspouts before freeze-up to prevent ice dams, overflow, and interior leaks. Debris like leaves and needles blocks water flow, which leads to ice forming in those troughs. (Gutter Dunn Eavestroughing Ltd.)

Also make sure every downspout actually extends away from the foundation. Winter melt pooling beside your basement wall is a slow, quiet problem buyers will ask about.

5. Shut off and drain exterior water lines — including sprinklers

Water expands when it freezes. If there’s water trapped in an exterior hose bib, irrigation line, or any plumbing that runs through or near an exterior wall, that line can split. You might not notice until you thaw, at which point it’s a basement surprise.

Edmonton fall checklists say:

Disconnect garden hoses.

Close the interior shutoff to each exterior tap.

Open the outside tap to let any remaining water drain out.

Blow out underground sprinkler lines before we hit a hard frost. Edmonton irrigation services advertise fall blowouts “starting at about $100–$150,” using high-powered air to clear the lines so they don’t crack underground. (inlinemudjacking.ca)

Insulate any exposed pipe in unheated areas (garage, crawlspace, unfinished basement) with foam sleeves or wrap. Alberta plumbing and winterization guidance specifically recommends wrapping pipes near exterior walls and cold spots to keep them from freezing and bursting. (EPCOR)

If you’re leaving town over winter, Edmonton’s water utility (EPCOR) advises:

– Do not turn your heat off.

– Keep the thermostat at about 12°C or higher.

– Ask someone to come in and run all taps, including showers, for a few minutes each visit to keep water moving so pipes don’t freeze. (EPCOR)

This is not just about comfort. A plumbing flood from a burst line is brutal for resale. Buyers see fresh drywall patches and immediately start asking, “Has there been water down here?”

6. Check your attic for air leaks and insulation gaps

In our climate, attic moisture is serious.

Here’s what usually causes those brutal ice dams you see hanging off people’s gutters in January:

Warm, humid indoor air leaks into the attic through gaps around light fixtures, attic hatches, bathroom fan penetrations, etc.

That trapped warmth melts roof snow from the underside.

Meltwater runs down to the colder eaves, refreezes, and forms an ice dam that can force water back up under shingles and into the house. (Roe Roofing)

Canadian cold-climate guidance is consistent: sealing attic bypasses and topping up insulation keeps heat where you actually want it (in the living space), reduces ice damming, and lowers how hard the furnace has to work. It’s one of the most cost-effective comfort and efficiency upgrades in a northern city like Edmonton. (The Department of Energy's Energy.gov)

Quick homeowner test: Pop the attic hatch on the first truly cold morning. If you see frost halos or dark, damp-looking rings around pipe penetrations or pot light boxes, that’s warm, moist house air leaking into the attic. Deal with it before deep winter.

7. Fix grading and drainage before the ground locks

Walk the perimeter of your house and look for:

Soil sloping toward the foundation,

Settled pockets under steps or decks where meltwater will sit,

Downspouts dumping right beside the wall.

Edmonton fall prep advice is clear: once the frost line sets, you’re basically stuck with whatever grading you’ve got until spring. If meltwater pools beside your foundation all winter and then freeze-thaws there, your basement is at higher risk for seepage — and basement staining is one of those instant “hmm, what happened here?” buyer red flags. (Gutter Dunn Eavestroughing Ltd.)

8. Test carbon monoxide (CO) and smoke alarms

Natural gas heat + closed windows + vehicles warming up in attached garages = higher CO risk in winter. You want:

Alberta safety and HVAC guidance treats CO monitoring in winter as critical because combustion appliances are running constantly and houses are sealed up. A clean safety story (“We test our alarms every fall”) gives buyers confidence that they’re stepping into a responsible, well-maintained home, not a science experiment. (atcoenergy.com)

9. Dial in your humidity (this is where Edmonton gets picky)

This is the part most homeowners get wrong, and it’s the part buyers see the second they walk in: condensation.

Warm indoor air holds moisture. When that moist air hits a cold surface (like a –25°C-facing bedroom window), the moisture condenses. That’s the fog, droplets, and sometimes even ice you see at the sill. Over time, that causes mould, swelling trim, peeling paint, and stained drywall — and that screams “maintenance issue” to buyers. Alberta home-maintenance pros warn that blocking airflow at windows with fully closed blinds in extreme cold traps that moist air and actually makes condensation worse. They recommend keeping blinds/curtains cracked and running the furnace fan to move air across the glass. (Lambert Brothers)

So what’s “healthy” humidity here?

Baseline guidance for Alberta / Edmonton homes in winter:

Aim for roughly 30% to 35% relative humidity in normal cold winter weather. Alberta HVAC providers and local home maintenance guides point to that ~30–35% RH range for winter comfort. (Alberta Mountain Air)

That range keeps the air from feeling painfully dry and helps protect wood floors and furniture, but still avoids most everyday condensation.

But — and this matters — you cannot keep it that high on true deep-freeze days.

Local furnace / HRV advice in Alberta is that you must dial humidity down as the outdoor temperature drops, or you’ll ice up your windows and door frames:

Around 0°C to –10°C outside: keep indoor RH around 25%–30%.

Around –10°C to –20°C outside: aim closer to ~20% RH.

When it’s colder than –20°C (which Edmonton absolutely hits): you may need to push humidity down toward 15%–25% RH to stop condensation and frost buildup on glass and trim. (Alberta Mountain Air)

That feels dry, yes. Your skin will complain. But if you try to sit at 40% humidity when it’s –25°C outside in Edmonton, you’re basically feeding moisture into your window frames, sills, and even wall cavities. High indoor humidity against very cold exterior surfaces can lead to mould, damaged trim, and even hidden moisture in walls and attic spaces. Local guidance warns that as outside temps plunge, indoor humidity has to come down to avoid long-term rot and mould. (Lambert Brothers)

Two very Edmonton-specific tips:

Keep blinds and curtains at least partially open in deep cold. Preventing airflow to the glass is “a sure way to cause condensation problems.” Cracking blinds and letting warm room air wash the glass helps, and letting sunlight hit the panes during the day can warm the glass surface so moisture doesn’t form. (Lambert Brothers)

Run the furnace fan / HRV. Running your furnace fan on “circulate,” or using your HRV (heat recovery ventilator) on a dry/cold setting, helps move air, scrub moisture, and keep humidity uniform — which keeps the windows clear. (Lambert Brothers)

This is huge for resale. Walk a buyer into a January showing with bone-dry windows and clean sills? They relax. Walk them into a house with black moldy corners under every bedroom window? They start mentally subtracting from your price.

10. Walk your driveway, walks, and steps

Any place water can sit and then freeze becomes a slip-and-fall zone later.

Before the freeze:

Look for settled/low spots in concrete that will turn into glare ice,

Check railings and exterior lights at the front door,

Make sure your exterior entry feels safe and well-lit.

From a liability standpoint, clearing ice and keeping walks safe is your responsibility. From a buyer standpoint, a clean, ice-free, well-lit entry in January reads “cared for,” not “project.” Local winter prep checklists in Edmonton specifically emphasize stocking ice melt and keeping high-traffic paths clear because once the first real snowfall hits, those supplies sell out fast. (Current Results)

11. Buy your ice melt, shovels, and blower fuel now

The first real snowfall in Edmonton hits and suddenly:

All the decent ergonomic shovels are gone,

Ice melt is sold out in a 20-block radius,

Everyone’s at Canadian Tire trying to get small-engine service.

Local winter prep advice is boring but true: get stocked before the first dump. You’ll want pet-safe ice melt (people absolutely check this during showings if they’ve got dogs or strollers), and you’ll want fuel stabilized for your snowblower while it’s still above freezing. (Current Results)

Also: during showings, nothing kills first impressions faster than “sketchy icy front steps.”

12. Check the weatherstripping on the garage-to-house door

That door is often where you feel the biggest blast of cold air. If the seal is worn or missing at the bottom or sides, you’re pulling –20°C garage air directly into your living space, which forces the furnace to work harder and contributes to drafts that buyers notice instantly.

Replacing door weatherstripping is cheap and, combined with sealing window/door gaps, is one of the easiest ways to cut heat loss and lower gas use in an Alberta winter. The U.S. Department of Energy and Canadian efficiency programs both call basic air sealing (caulking, weatherstripping) one of the fastest payback moves — often within a year — and note it can reduce heating bills by 10–20% or more in drafty homes. (The Department of Energy's Energy.gov)

13. Re-caulk penetrations and cold corners

Any spot where something passes through an exterior wall — hose bibs, electrical, cable, gas line, HRV vent, bathroom fan duct — is a chance for cold air in and warm/moist air out.

Plumbing and home-maintenance guidance for Edmonton and Alberta says to seal those penetrations and insulate pipes on exterior walls to prevent freezing. That’s especially important for kitchen sinks and basement bathrooms that sit on an outside wall; those are classic freeze points in older Edmonton layouts. Experts here also advise opening cabinet doors under sinks during extreme cold so warm air can reach those pipes, and to keep interior doors open so heat circulates into colder zones. (EPCOR)

Also check corners and the rim-joist area in the basement (where the main floor framing meets the foundation wall). Frost there is a sign of air leakage + high humidity.

14. Get the outdoor stuff handled before it’s entombed in snow

Before the first serious snowfall and freeze/thaw cycle:

Bring in patio cushions and furniture.

Drain and store hoses.

Tie down bins if you’re in a windy west/southwest pocket (Secord, Rosenthal, parts of Edgemont and The Hamptons get gusts across open fields).

Put away kids’ bikes / outdoor toys unless you want to chip them out in March.

A shocking number of “mystery basement leaks in March” start because a forgotten, still-connected hose line froze and split. Edmonton winterization providers flat-out warn that any trapped water in exterior or irrigation lines will freeze, expand, and crack fittings or valves, which can lead to leaks toward the foundation once things thaw. (inlinemudjacking.ca)

This is less about resale and more about not being mad at yourself in February.

15. Build and label your emergency kit

When we get a true Arctic high over the city, furnaces fail. That’s just honest.

You want:

A safe portable space heater,

Heavy blankets,

Flashlights,

The number of the plumber / HVAC company you trust,

Written instructions for how to shut off main water and gas.

Why write it down? Because if you’re not home and someone else is housesitting, you don’t want them guessing while the house drops from 20°C to 10°C. Local plumbing and HVAC pros warn that frozen pipes plus delayed action equals major damage and insurance drama. The faster you act, the less likely you are to end up with a burst line, soaked drywall, and an insurance claim you now have to disclose. (EPCOR)

If you’re selling: having a “home binder” that shows maintenance, emergency plans, and receipts is a surprisingly strong trust-builder with buyers.

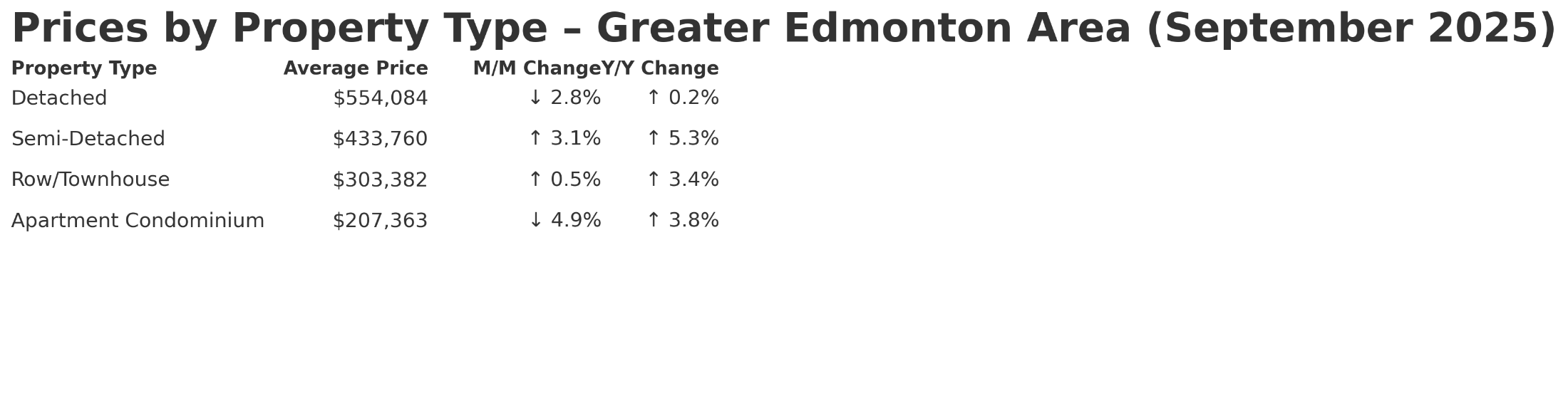

Why all of this matters for resale

Buyers here don’t just look at paint color. They look at survival.

When someone walks into your house in January and notices:

It’s evenly warm,

The air doesn’t feel desert-dry or sauna-humid,

The windows aren’t sweating,

There’s no ice hanging off the eaves,

The basement smells dry, not “thawed snow,”

The furnace sounds smooth, not desperate,

…they immediately assume you’ve taken care of the expensive parts of homeownership in Edmonton — heat, moisture, structure. That is literally what you’re selling.

This is how you protect your asking price in winter.

Edmonton Winter FAQ

Q: What’s a healthy indoor humidity target for Edmonton in winter?

For typical cold (say –5°C to –10°C outside), aim roughly 30%–35% RH. Alberta HVAC providers and local home-maintenance pros recommend that range for winter comfort because it helps with dry skin, static, hardwood shrinkage, etc., without instantly fogging every window. (Alberta Mountain Air)

When we’re in a deep freeze, drop it. Around –10°C to –20°C outside, run closer to ~20% RH. At colder than –20°C (which Edmonton absolutely hits multiple times most winters), you may need 15%–25% RH to stop condensation and ice on glass and door frames. Local guidance stresses that you must step humidity down with the outdoor temperature or you risk mould and rot in framing and window wells. (Alberta Mountain Air)

If you see beads of water or frost at the bottom of your windows in the morning, your humidity is too high for that outdoor temperature. Lower it a few percent at a time until the glass stays clear, crack blinds to let warm air wash the glass, and run the furnace fan/HRV to move air. (Lambert Brothers)

Q: Why do my windows “sweat” at night and then freeze?

At –20°C, your window glass is cold enough that warm indoor moisture condenses instantly. Overnight, that moisture can freeze into ice ridges along the sill. That trapped moisture can rot trim or feed mould. Edmonton home-maintenance pros warn that fully closing blinds in extreme cold traps moist indoor air against freezing glass and makes condensation worse. Cracking blinds, letting sunlight warm the glass during the day, and dialing humidity down on the coldest nights are all standard Alberta advice. (Lambert Brothers)

Q: I’m leaving for a week in January. Can I just turn the heat way down to save money?

Do not kill the heat. EPCOR, which handles water for Edmonton, says you should never shut the heat off in winter. If you’re going away, keep the thermostat at about 12°C or higher and have someone come in and run every tap and even showers for a few minutes each visit. The goal is to keep water moving so pipes don’t freeze and burst while you’re gone. (EPCOR)

Q: Do I really have to blow out my sprinklers? It’s already off for the year.

Yes. Turning the controller off does not empty the lines. Edmonton irrigation companies warn that any water left in underground lines can freeze, expand, and crack pipes, fittings, and valves, and that blowouts (often starting around $100–$150 here) are specifically meant to clear every zone with compressed air before a hard freeze. (inlinemudjacking.ca)

Q: Can I just sell “as-is” in winter and let the buyer deal with all this?

You can — but here’s the truth. Winter buyers in Edmonton are serious and usually pre-approved, but they’re also cautious. If they see ice dams, sweating windows, funky smells in the basement, or a furnace that sounds rough, they’ll price in “risk.” That usually means a lower offer. If your place feels tight, warm, dry, and maintained, you keep leverage. (Gutter Dunn Eavestroughing Ltd.)

Need Help?

If you’re finding this information to be a bit overwhelming, don’t stress! Mike Pabian has partnerships with several local service providers, and will be happy to help you get your home in tip-top condition for winter. Whether you want to know what your house is worth, need help organizing, or just want to bounce ideas off of someone that does this for a living, reach out! Call or text Mike at 780-232-2064 today.