Upgrading your home can be one of the most impactful, and financially rewarding, things you can do to achieve your goals. If not done the right way, however, you can spend a lot of money that you’ll never get back. Worse, you could actually end up making choices that turn buyers off. In this guide we’ll discuss some of the easiest and least expensive things you can do to ensure a quick and profitable sale. We’ll also look at more complex upgrades - and with more complexity comes more time, effort, money and stress. It’s like anything else - as the potential return on investment increases, so too do the costs. Risk does not always equal reward, but with these tips you’ll be empowered to make smart decisions that fit your budget.

TL;DR — Edmonton Renovation ROI (Fast Facts)

Start small: deep clean, neutral paint, modern lighting/hardware, and curb appeal—your best photo & showing ROI per dollar.

Level up smartly: bathroom/kitchen refreshes (not guts), flooring continuity, and simple energy wins (air-sealing/insulation, smart thermostat).

Go big only when the math works: full kitchen/bath, basement finishing, or a legal secondary suite with permits can pay off if comps support it.

Universal > personal: keep big, fixed finishes neutral and timeless; save bold choices for easy-to-reverse accents.

Sometimes, don’t renovate: list clean, staged, and well-priced when timelines or comparable sales make renos risky.

Documentation sells: permits, receipts, warranties, before/after photos, and pre/post utility bills build buyer confidence.

Tier 1 — Quick & Cheap (High Appeal, Low Cost)

Deep clean + minor repairs (1–2 days, DIY-friendly)

Hit the “photo zones” first: entry, kitchen, living room focal wall, primary bedroom, and the first bathroom buyers see. Scrape and re-caulk tubs, showers, and sinks; steam-clean and reseal grout. Tighten hardware, adjust door strikes so doors latch smoothly, add bumpers to stop cabinet rattles.

Edmonton winter note: add felt pads to chair legs to prevent floor scuffs when snow/water gets tracked in.

Neutral paint (2–4 rooms = big lift)

Choose one undertone across the main floor (e.g., warm greige). Ceilings: flat; trim/doors: semi-gloss; walls: eggshell/satin. Patch → sand → prime (spot prime stains) → roll entire wall to avoid sheen “flashing.”

Lighting + switches (2–4 hours)

Swap builder domes for low-profile LED flush mounts; keep a single color temperature (2700–3000K) throughout. Replace yellowed switches/receptacles and cracked plates.

Weather-sealing (Edmonton climate)

Replace door sweeps and worn weather-stripping; check attic hatch gasket. Install a fresh furnace filter before showings—quieter airflow and less dust.

Basic curb appeal (any season)

Winter: clear to bare pavement, dark coco mat, simple evergreen planter.

Summer: edge beds, add 3–4" dark mulch, prune branches away from windows for light.

Avoid

Patch-only touch-ups that “flash” in photos, mixed bulb colors/temperatures, and random accent walls that break visual flow.

Tier 2 — Moderate Budget (Targeted Refreshes with Broad Appeal)

Bathroom refresh (not a gut)

High-impact trio: new vanity top + faucet, mirror, and LED vanity light. Replace pitted chrome; standardize one finish home-wide (brushed nickel/matte black). Clean and reseal grout; only re-tile small areas if needed with durable materials. Avoid moving plumbing unless function is broken.

Kitchen mini-makeover

If cabinet boxes are solid, spray doors/frames with a durable 2-part finish or hire pros. Keep backsplash simple (matte, mid-tone, classic patterns). Add undercabinet LEDs and a modern pull-down faucet.

Hardware proportion: 5–6″ pulls on uppers; 6–8″ on lowers.

Flooring continuity

Unify mixed floors with one water-resistant LVP line through main living areas. Refinish existing hardwood in mature neighbourhoods—authenticity sells.

Exterior value plays

A new entry door (solid core + quality hardware) and a clean, modern garage door change first impressions and photos.

Selective energy upgrades

Air-sealing, insulation top-ups, and a smart thermostat are tangible wins. Save receipts and, if possible, pre/post utility statements to prove operating-cost savings.

Avoid

Trendy overkill (busy patterned tile everywhere), mixing three+ metal finishes, and shiny budget vinyl that telegraphs “cheap.”

Tier 3 — Major & Expensive (Proceed Only When the Math Works)

Full kitchen (scope discipline)

Prioritize layout flow, storage, and durable surfaces. Mid-range finishes often outperform luxury on ROI.

Countertops: mid-tone quartz hides crumbs/water spots better than ultra light/dark. Lock finishes to in-stock or short-lead items to avoid timing risk.

Primary bathroom overhaul

Plan low-curb/curbless showers with professional waterproofing and a properly sloped floor. Keep one tub in the home for family buyers. Upgrade to a quiet, properly ducted bath fan (no recirculating) to manage winter humidity.

Roof, windows, and major systems

Document install dates, warranties, and contractors in a simple PDF packet. If adding a suite/EV readiness, consider an electrical panel update and label circuits neatly.

Basement finishing (with permits)

Create one bright multifunctional space (office/rec/guest) plus organized storage. Use appropriate insulation (e.g., rigid foam/rockwool where suitable). Specify warm-temperature LED lighting and abundant outlets.

Secondary suite (where zoning allows)

Plan for egress, fire separation, sound attenuation, ceiling height, independent smoke/heat detection, and private entry sightlines. In winter, design stairs/walkways for safe snow/ice management. Price against actual local rents and recognize value is both income and resale pool expansion.

Avoid

Luxury overbuild for the street, moving structural walls casually, and unpermitted “almost a suite” spaces that spook buyers, lenders, and insurers.

Kitchen Flow Terms (Plain-English)

Work Triangle (Kitchen Flow)

The imaginary triangle between fridge, sink, and stove/cooktop—the three most-used points. Short, clear paths make cooking feel effortless.

1-Minute Fix: clear obstructions (stools, bins, portable islands, pet bowls), relocate small appliances that block the sink-to-stove line, and keep corners visually open.

Landing Zones (Safe Set-Down Space)

Clear countertop patches beside the stove, sink, fridge, and oven—places to land hot pans and groceries. Aim for 18–24″ of uninterrupted counter near each.

1-Minute Fix: unclutter those areas; prioritize a clean pad beside the stove and sink; move knife blocks/bread boxes to free space.

Renovation Reality Check: When Not to Renovate

If the market time/value math fails: Comparable sales set a ceiling. In fast-moving segments, speed-to-market can beat months of construction.

If the plan is highly personal: Niche finishes or removing bedrooms/storage shrinks your buyer pool. I can’t stress this enough - don’t make changes because YOU think they’re the right changes to make. Mass appeal should be your goal, always and in all ways.

If you’ll cut corners: Poor workmanship backfires—better to do less, done right than more, done poorly. If you think you can do it yourself - DON’T. Buyers are more educated now than ever. When I walk through a home, I’m looking for uneven grout joints, a lack of caulking on the backsplash, floors that are wonky, paint that wasn’t taped off, and so, so much more. I’ve seen million-dollar homes with “I learned tile in 2 hours on Sunday at Home Depot” tile jobs or showers that will be growing mold after 2 showers. If you’re not a professional, you’re better off just not doing the upgrade at all. If you can’t afford to do it well, you certainly can’t afford to do it poorly.

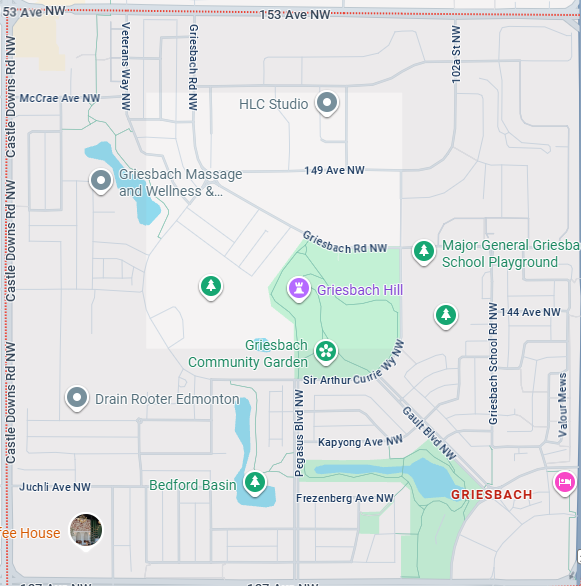

Edmonton-Specific Must-Knows

Permits & inspections: Many projects require development/building permits (plus separate electrical, plumbing, gas, HVAC). Confirm before you start (call 311 or check the City’s site).

Budget for soft costs: Permit/inspection fees and sometimes engineered drawings.

Insurance updates: Notify your insurer after material changes so coverage reflects new value/features.

Advanced Staging & Photo Strategy

Sightline audit: From the front door and each doorway, what’s the focal point? Stage that first.

Hang height: Art centers at ~57–60″; align top edges for a calm look.

Texture & tone: Use 2–3 textures (wood, knit, greenery) and 2–3 neutral tones per room.

Window treatments: Remove heavy drapes; hang light panels high/wide to “grow” the window.

Scent: Skip strong fragrances/ozone; fresh air + a subtle neutralizer is safer.

Pricing & Timing (When “No Reno” Wins)

Velocity vs. perfection: In entry-level segments with high absorption, a clean, well-priced listing can beat a 6–10 week reno.

Cost of delay: Weigh carrying costs and seasonality—spring/summer tends to have more foot traffic in Edmonton.

Credit option: Offer buyer credits (e.g., “choose your backsplash”) instead of rushing an install—zero punch-list risk.

Documentation That De-Risks Your Sale

One-pager summary: dates, scope, contractors, permit numbers, and warranty expiries.

Before/after photos with simple labels. If your real estate agent doesn’t hire a professional photographer, fire them and find someone that will. Your goal is to get people to want to click on your house online - people are buying homes on Instagram, on their phones, and on their couch via websites like Realtor.ca. Cheap photos = no views = no showings. This could cost you thousands. First impressions matter.

Utility history: 6–12 months, especially if you improved insulation or windows, or upgraded/serviced water heaters, furnaces, appliances or your roof.

Manuals + receipts: scan to PDF; keep a printed binder for showings.

Permit folder: approvals and final inspections tabbed—buyers and appraisers value this.

Quick Decision Framework (Use This Before You Spend)

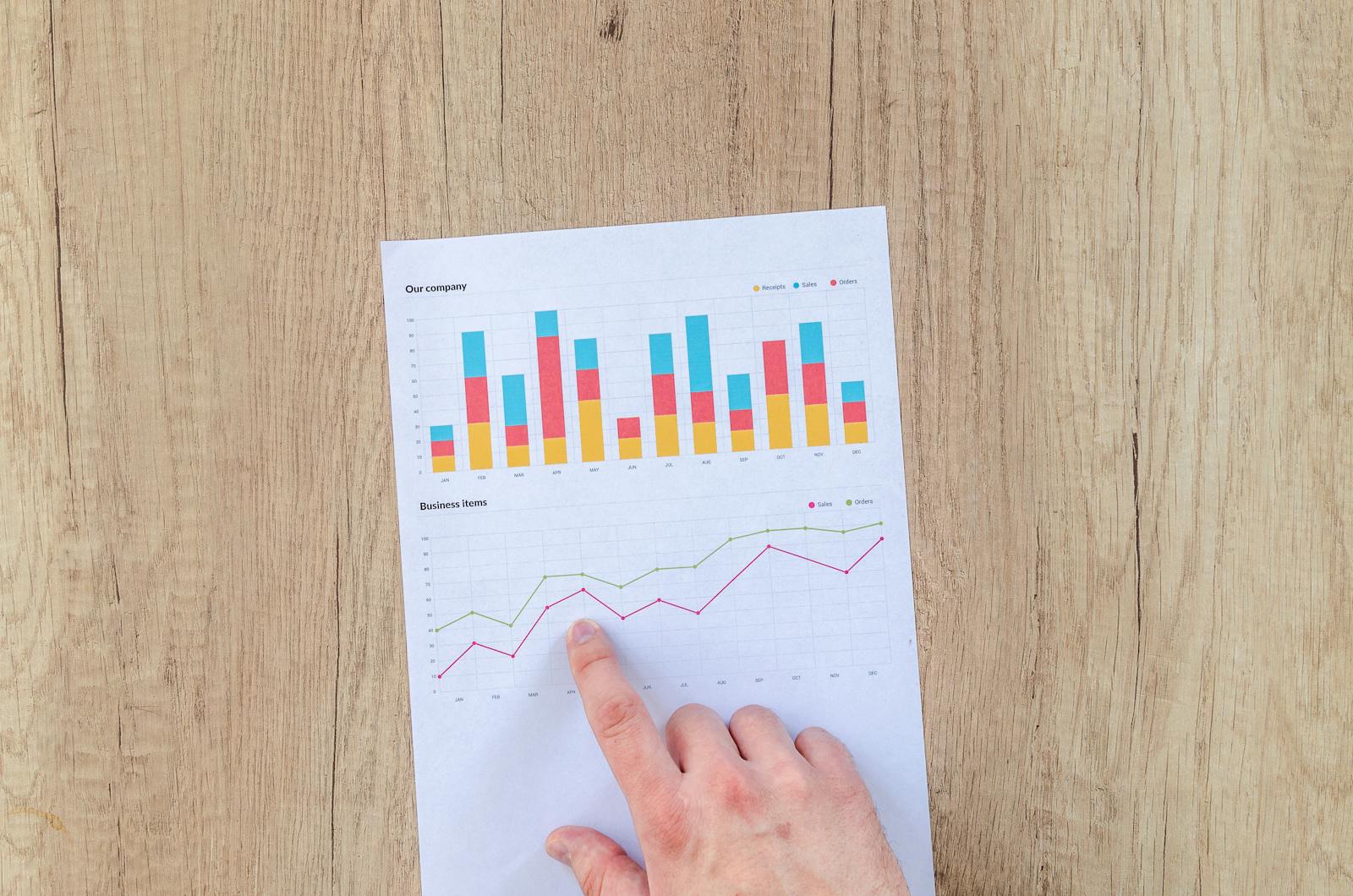

Market check: Compare “updated” vs “original” sold comps (last 60–120 days).

Scope discipline: Prefer refresh over reconfigure unless you’re fixing a clear functional flaw.

Universal first: light, clean, efficient, low-maintenance > niche or luxury.

Compliance: Confirm permits/codes up front and schedule inspections.

Financing incentives: Check City CEIP and the Canada Greener Homes Loan for timelines/eligibility.

FAQ

Do I need permits for cosmetic work?

Painting, flooring swaps, and similar cosmetic tasks typically don’t require permits; finishing basements, secondary suites, adding/removing walls, new circuits, or plumbing usually do. When in doubt, call 311 or consult the City’s permit pages.

What delivers the best bang-for-buck before listing?

Deep cleaning, strategic paint, lighting, minor repairs, curb appeal, and small kitchen/bath refreshes. They improve photos, showings, and buyer confidence at relatively low cost.

Should I finish the basement or price accordingly?

Run the numbers with your REALTOR®. In some segments, launching fast with a sharp price outperforms a months-long build. A clean, permitted space helps—an unpermitted one can hurt.

Are energy upgrades worth it for resale?

Air-sealing/insulation, smart thermostats, and efficient windows reduce ownership costs and can widen your buyer pool. Check CEIP and federal loan timelines for incentives and keep documentation.

Is carpet okay anywhere?

Yes—in basement family rooms or bedrooms for warmth and acoustics. Elsewhere, continuous hard surfaces enhance visual flow.

What’s the best small splurge?

A statement dining/entry light. It shows in photos, signals “updated,” and doesn’t lock you into a trend.

Do I need to replace all windows to see value?

No. If most are sound, replace the worst offenders (failed seals, leaks) and refresh trim/caulk. Providing quotes for any remaining windows helps buyers understand the path forward.

Will a hot tub or elaborate landscaping help?

Usually not for ROI; both suggest maintenance. Keep landscaping simple, tidy, and drought-aware.

Can I DIY to save money?

Yes—if you can achieve professional results and comply with code. Poor workmanship triggers buyer discounts and inspection issues. Consider pros for tile, electrical, plumbing, and envelope work.

What about EV charging?

If panel capacity allows, adding a permitted 40A circuit + NEMA 14-50 (or a wall unit) is a subtle future-proofing perk. If capacity is tight, get and share an electrician’s quote.

How do I avoid over-improving for my street?

Match the top five sold comps within ~0.5–1.0 km. If your planned finishes push you far above those sales, tighten scope.

When is ‘no renovation’ the right call?

If comps set a firm ceiling, timelines are tight, or budget is limited—launch clean, staged, and well-priced. You can always credit buyers instead of undertaking risky projects.

Appendix A — Seller Prep & Photo Checklist

Week-Before Listing

Declutter rooms/closets by 30–40%; store off-site if needed.

Deep clean kitchens/baths; recaulk tubs, showers, and sinks.

Replace burnt bulbs and match color temperature (2700–3000K).

Patch nail holes; touch-up paint on high-traffic walls/trim/doors.

Curb appeal: mow/edge, trim shrubs, fresh mulch, sweep walks, clean/repaint front-door hardware.

Replace yellowed switch plates/vents; tighten loose handles/hinges.

48 Hours Before Photos

Stage entry, living, kitchen, and primary bedroom (simple + cohesive).

Clear counters; hide small appliances; add one fresh element (greenery/citrus).

Remove personal photos/identifiers; secure valuables.

Clear driveway/curb; hide bins/hoses; wipe exterior glass.

Day-Of Photos/Showings

Lights on, blinds open; toilet lids down; neutral towels.

Put away pet items; air out spaces.

Quick wipe: mirrors, glass, stainless, taps; vacuum high-traffic areas.

Proof Package for Buyers/Appraisers

One-page reno summary: dates, scope, contractors, permit numbers, warranties.

Before/after photos of major updates.

Pre/post utility bills if you did efficiency upgrades.

Manuals/receipts filed and ready to share.

Appendix B — Reno Decision Framework (One-Page)

Step 1 — Market Check

Pull 5–8 recent sold comps (last 60–120 days). Note price delta between “clean/original” vs “updated.” If delta < cost + hassle, don’t renovate; list clean and sharp.

Step 2 — Scope Discipline

Prioritize universal: light, clean, efficient, low-maintenance. Prefer refresh (paint/fixtures/backsplash) over reconfigure (moving walls) unless fixing a clear functional flaw. Avoid removing bedrooms/closets or the only tub in the house.

Step 3 — Compliance First (Edmonton)

Confirm permits for basements, secondary suites, structural changes, new circuits/plumbing/HVAC. Plan inspections; keep approvals and photos—buyers and appraisers care.

Step 4 — Time-to-Market

In hot segments, speed + pricing can beat months of renos. Consider buyer credits for discretionary upgrades rather than rushing a big project.

Step 5 — Energy Incentives

If doing efficiency work, check CEIP (City of Edmonton) and Canada Greener Homes Loan timelines/eligibility before you start. Save invoices and utility data to demonstrate operating-cost wins. Note: The Greener Homes Loan will end October 1, 2025.

Sources & Further Reading

RE/MAX Canada — The Best Home Renovations for the Biggest ROI — blog.remax.ca/best-home-renovations-biggest-roi/

Intact Insurance — How to Increase Home Value: A Cost-Effective Reno Guide — intact.ca/en/blog/increase-home-value-cost-effective-reno-guide

City of Edmonton — Renovations, Basements, Secondary Suites & Permits (for current requirements/fees)

Government of Canada — Canada Greener Homes Loan (for current eligibility/timelines)

Ready to talk strategy?

Thinking of selling in the next 3–6 months? I’ll build you a room-by-room punch list, pull live comps, and map a reno/staging plan that fits your budget and timeline. Call/text 780-232-2064 or DM @pabianrealty—I’ll help you focus on the few upgrades buyers actually pay for in your exact micro-market.